CAR Risk undertakes studies across the full spectrum of natural and man-made hazards which affect the built environment.

CAR Risk is a leading UK consultancy with an international reputation in risk studies. CAR’s vulnerability-based approach has been used in projects including catastrophe perils such as earthquake, volcanic eruption, tropical and temperate windstorm, and flood, as well as routine perils such as subsidence, burglary, and unexploded ordnance.

What we do

CAR was founded in 1987 by a group of academics from the Martin Centre for Architectural and Urban Studies, a research unit within Cambridge University’s Department of Architecture. The Martin Centre has many years’ experience of research on the vulnerability of the built environment to a wide range of natural and man-made hazards.

From the foundation of CAR, risk in the built environment has been a core area of the company’s activities. CAR’s early experience in this field focused on conducting damage surveys in the aftermath of major events, analysing building damage and correlating damage levels with earthquake intensity and construction type. These first-hand data formed the basis for the development of CAR’s expertise in risk assessment and mitigation in developing countries and earthquake-prone regions around the world, carried out for government agencies and international organisations involved in civil protection and post-disaster recovery.

Before long, CAR’s know-how attracted the attention of private sector clients such as insurance companies, who saw the potential for integrating CAR’s vulnerability models with their existing earthquake occurrence models to produce a more accurate loss estimation capability. During the 1990s, CAR extended its risk modelling capability in breadth and depth, developing models for a wide range of perils and territories, as well as co-operating with hazard specialists to develop standalone risk models capable of offering clients a turnkey solution.

When CAR first became involved in risk studies in the 1990s, the science of catastrophe modelling was predominantly hazard-driven, with the emphasis placed on predicting the frequency, severity and geographic distribution of natural hazards, while the building stock exposed to these hazards was assumed to be a largely homogenous entity with limited variation in vulnerability between building types or geographic regions.

This approach reflected the scarcity of reliable data on building performance around the world, but it represented a fundamental weakness in the science, insofar as risk is a function of both hazard and vulnerability. Only vulnerability can explain why a small earthquake in India results in higher casualties and more destruction than a large earthquake in California.

Furthermore, while earthquakes and hurricanes are natural phenomena which are inherently difficult to predict, buildings are man-made structures whose performance is more susceptible to prediction and modification. By focusing systematically on the vulnerability of buildings and infrastructure, CAR has been able, in co-operation with hazard specialists, to significantly refine the loss prediction process.

With its research hinterland in the fields of structural engineering and building technology, CAR was ideally qualified to make this important contribution to the science of catastrophe modelling, which has now become a standard feature of state-of-the-art catastrophe models worldwide.

‘Why Do Buildings Collapse in Earthquakes?: Building for Safety in Seismic Areas’ delivers an insightful and comprehensive analysis of the key lessons taught by building failures during earthquakes around the world. The book uses empirical evidence from the authors’ involvement over several decades in post-earthquake field missions with EEFIT, and research projects with Cambridge Architectural Research, to describe the successes of earthquake engineering and disaster preparedness, as well as the failures that have in many cases had tragic consequences.

The book explains what makes buildings in earthquake zones vulnerable, what can be done to design, build and maintain buildings to reduce or eliminate that vulnerability, and what can be done to protect occupants. Those who are responsible for the lives and safety of occupants – architects, designers, engineers, and building owners or managers – will learn how to provide adequate safety and shelter.

The illustrated book includes:

· A thorough introduction to how buildings have behaved in earthquakes, including a description of the world’s most lethal earthquakes and fatality trends over time

· An exploration of how buildings are constructed around the world, including the impact of climate and seismicity on home design

· A discussion of what happens during an earthquake, including the types and levels of ground motion, landslides, tsunamis, and sequential effects, and how different buildings tend to behave in response to those phenomena

· Profiles of individuals who have made pioneering contributions to earthquake safety over recent years.

Authors: Robin Spence, Emily So

Robin Spence is a Structural Engineer, Director of Cambridge Architectural Research Ltd, and Professor Emeritus of Architectural Engineering at the University of Cambridge. He was President of the European Association for Earthquake Engineering (2002-2006), Mallet-Milne Lecturer at the Institution of Civil Engineers (2007), and Nicholas Ambraseys Lecturer at the European Conference on Earthquake Engineering, Istanbul, (2014).

Emily So is Professor of Architectural Engineering at the University of Cambridge and a chartered civil engineer. She is Deputy Head of the University’s School of Arts and Humanities. She is also Director of the Cambridge University Centre for Risk in the Built Environment, Director of Studies and Fellow in Architecture at Magdalene College. She won the Earthquake Engineering Research Institute’s (EERI) 2010 Shah Family Innovation Prize.

ISBN: 978-1-119-61942-0

Since CAR’s foundation, CAR experts have been leading the expansion of risk management expertise in Cambridge, from research to consultancy and through to the development of risk management systems for business applications. In 1993, CAR spun off a commercial venture, CARtograph Ltd, focused on the production of geographic risk management systems for the UK insurance and international reinsurance industries. Commencing life as a six-person start-up, within five years CARtograph grew into the leading European company within its field, before merging with the current global leader Risk Management Solutions (RMS Inc.) of San Francisco, USA.

In 1998 Prof. Robin Spence, Director of the CAR Risk Group, established the Cambridge University Centre for Risk in the Built Environment (CURBE) a multi-disciplinary forum designed to foster research co-operation between different departments of Cambridge University involved in the risk field, including the Departments of Architecture, Engineering, Geography, Public Health and Earth Sciences.

In 2008, Dr. Andrew Coburn (currently Senior Vice President at RMS Europe, and co-founder of CAR and CARtograph) established the Centre for Risk Studies, a research unit within Cambridge University’s Judge Institute of Business Studies. These developments have made Cambridge today a leading centre of expertise in risk management. CAR is at the centre of these developments and plays a crucial role in converting research excellence into practical advice and support for decision-making for its international client base.

Through its close links with the University of Cambridge, CAR is part of a global network of research institutions specialising in the risk management field. This allows CAR to access the most authoritative data sources swiftly and economically, to assemble, lead or participate in international consortia for multi-disciplinary projects, and to achieve a truly global reach in its data gathering and risk analysis capability.

Services

Catastrophe modelling

Introduction

CAR’s approach to catastrophe modelling has in large part been developed in co-operation with insurance clients and partners and so reflects the needs of the UK insurance and international reinsurance industries, in terms of the range of perils and territories covered and the focus on loss estimation for buildings, contents and business interruption. CAR’s models use industry-standard geocoding, such as postcode, administrative unit or CRESTA zone, to provide country-specific loss estimates for large residential, commercial and industrial property portfolios.

These outputs can be used by reinsurance companies to price their reinsurance treaties or by primary insurers and their brokers to control their exposure and optimise their reinsurance purchasing. CAR’s models are not black boxes, but are designed to be easily integrated with clients’ existing in-house or third party models, or to be used on a standalone basis.

Peril coverage

CAR has experience of modelling the vulnerability of the built environment to a wide range of natural and man-made perils, including the following:

Catastrophe perils

Earthquake

Volcanic eruption

Tropical and temperate windstorm

Riverine flood, storm surge and tsunami

Routine perils

Subsidence

Burglary

Unexploded Ordnance (UXO)

Territorial coverage (Earthquake)

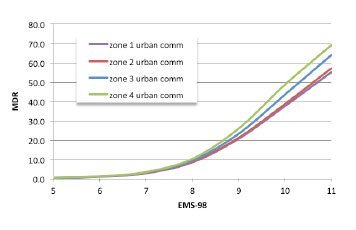

CAR has developed vulnerability models for 35 countries and territories across 5 continents, covering most of the countries of primary interest to the international insurance and reinsurance industries.

The Global Event Vulnerability Estimation System (GEVES) is a model for estimating losses to property portfolios from catastrophe events. Designed for insurance and reinsurance applications, GEVES is designed to be integrated with clients’ existing hazard models to upgrade their loss estimation capability, or to be used on a standalone basis to estimate losses from a given event.

Initially focused on earthquake risk, the GEVES model range has in recent years been broadened to a multi-peril capability with the development of typhoon vulnerability models for China and Japan. These models utilise the underlying GEVES structure and methodology but adapt them to the requirements of windstorm modelling.

Risk assessment and mitigation

Overview

Owners of large portfolios of buildings and urban authorities are frequently faced with the problem of assessing the risks to the building stock for which they are responsible and deciding on the most effective strategy for mitigating that risk. CAR has experience of working with clients whose concern is either with a single facility or an entire urban system, and has developed approaches appropriate to each situation.

Single facility risks

Companies owning large commercial or industrial buildings and facilities cannot rely solely on their insurers to manage their risk, either because facultative insurance can be prohibitively expensive if the buildings are considered high-risk, or because they face increasingly onerous regulations which were not anticipated when their ageing buildings were designed.

Yet, routine demolition of existing buildings every time the building regulations are revised is economically unrealistic and often unnecessary, since the fact that a building does not comply with current regulations does not automatically mean that it is unsafe. In such cases, CAR can employ its probabilistic approach to assess the risk for any given facility and recommend cost-effective solutions for reducing that risk to acceptable levels and ensuring that the building can continue to be safely used until the natural end of its life.

Such recommendations may involve strengthening or replacing compromised elements of the building’s structure or cladding, or introducing simple changes in the management of the building, for example ensuring that the large doors of an industrial shed are kept closed during a windstorm to minimise air pressure differentials. This approach, which is based on a detailed analysis of the structural system, can often save the client millions of pounds in unnecessary rebuilding costs and high insurance premiums.

Urban systems

In the case of public sector clients such as government and international agencies responsible for civil protection, the focus on risk mitigation is even stronger, although the task usually involves analysing entire urban settlements or even regions rather than individual buildings. CAR has a long track record in carrying out studies of this kind in many countries. The objective of such work is to evaluate the risk in terms of human casualties and building damage, and use this evaluation to propose a comprehensive mitigation strategy potentially covering everything from development control, new building regulations, advice on repair and retrofitting of the most vulnerable buildings, conservation plans for historic buildings, through to the design of disaster relief and recovery plans.

CAR helped coordinate the Global Earthquake Consequences Database (GEMECD) between 2012-2014. This is a GIS relational database that aims to inform users about the consequences of the most significant earthquakes in the past 40 years and provide a benchmarking tool for analytical loss models in the future. The project included the development of an interface enabling damage from future earthquakes to be captured and uploaded to the database. GEMECD is a repository of the most relevant and validated data on the consequences of the important earthquakes of the last century.

GEM brings together experts from leading universities and research organisations around the world, including Cambridge Architectural Research.

See GEM’s openquake website for details

Disaster recovery

CAR has 30 years’ experience of monitoring, evaluating and advising on recovery after major disasters.

Together with experts in the University of Cambridge Department of Architecture and the Centre for Risk Studies at the Cambridge Judge Business School, we have conducted over 100 case studies of natural disasters, ranging from some major historic events to more recent disasters. They include 30 floods, 29 storms, 21 earthquakes and 23 earthquakes and tsunamis.

The case studies are aimed at answering three fundamental questions about natural disasters.

1 Why do many more people die in certain disasters and not others?

2 Why do some places recover faster than others after a disaster?

3 Why do some countries build back better?

One of the key findings is that decisions made, and actions taken in the immediate aftermath of a disaster have a profound impact on the long term recovery and reconstruction of the affected settlements and the communities which inhabit them. Natural disasters, while a tragedy for the stricken communities, also present a ‘window of opportunity’ to build back better.

CAR’s expertise in measuring the speed and quality of disaster recovery and in analysing the underlying causal factors in recovery is of interest to national and regional governments in hazard-prone countries, to disaster management professionals, to insurers and reinsurers and to international aid organisations and funders.

Earthquake recovery case studies include:

Northridge, USA 1994

Bam, Iran 2003 (survey 2014)

Indian Ocean 2004 (survey 2009)

Kashmir, Pakistan 2005 (survey 2006)

Wenchuan, China 2008 (survey 2012)

L’Aquila, Italy 2009 (survey 2012)

Maule, Chile 2010 (survey 2011)

Christchurch, NZ 2011 (survey 2012)

Tohoku, Japan 2011 (survey 2013)

Van, Turkey 2011 (survey 2012, 2013)

Nepal, Gorkha 2015 (survey 2018)

Storm and flood recovery case studies include:

Philippines, Typhoon Haiyan 2003 (survey 2018)

Bangladesh floods 2004

USA Hurricane Katrina 2005

UK Cyclone Kyril floods 2007 (survey 2018)

USA Hurricane Sandy 2012

Germany Cyclone Xavier floods 2013 (survey 2018)

Vietnam Typhoon Haiyan 2017 (survey 2018)

Disasters leave huge scars in people’s lives, the economy and infrastructure. Yet despite the damage there are opportunities to ‘build back better’. The process of recovery involves planning at various levels including international, national, regional and local. We need to understand a disaster and track what is happening with the process of recovery to help plan reconstruction and to learn lessons to mitigate future disasters.

CAR Director Stephen Platt has conducted field studies and surveys after 14 major disasters.

Earthquake recovery

Bam, Iran 2003 (survey 2014)

Indian Ocean 2004 (survey 2009)

Kashmir, Pakistan 2005 (survey 2006)

Wenchuan, China 2008 (survey 2012)

L’Aquila, Italy 2009 (survey 2012)

Maule, Chile 2010 (survey 2011)

Christchurch, NZ 2011 (survey 2012)

Tohoku, Japan 2011 (survey 2013)

Van, Turkey 2011 (survey 2012, 2013)

Nepal, Gorkha 2015 (survey 2018)

Storm and flood

Philippines, Typhoon Haiyan 2003 (survey 2018)

UK Cyclone Kyril floods 2007 (survey 2018)

Germany Cyclone Xavier floods 2013 (survey 2018)

Vietnam Typhoon Haiyan 2017 (survey 2018)

Projects

UK Flood 2007

Disaster recovery: AXA case study of ‘game changer’ flood with household survey in Sheffield-Rotherham and national expert survey.

Earthquake Impact Database 2007-2018

Damage Assessment: Web-accessible database of past earthquake damage data constructed to support earthquake risk projects.

Typhoon Osaka Japan 2018

Disaster recovery: Typhoon damage to a gym structure in the Sakai area of Osaka Metropolitan Region, Typhoon Jebi, September 2018. Part of a study for the development of the GEVES Japan Typhoon Vulnerability Model (1.0) carried out for Guy Carpenter in 2018.

Typhoon Haiyan Philippines 2013

Disaster recovery:

AXA case study with field study and expert survey and collaboration with KIT to produce tourism scorecard.

Netherlands Earthquake 2014-2016

Risk Assessment: Contribution to Arup/NAM study of risks to buildings and occupants in the Groningen Region from earthquakes induced by gas extraction.

International Macroseismic Scale 2015-2024

Earthquake Risk Assessment: Preparation of supporting documentation on the development of the IMS as a successor to the MMI and EMS macroseismic scales (supported by GEM, the Global Earthquake Model 2015, and ATC, 2023)

Gorkha Earthquake Nepal 2015

Disaster recovery:

Collaboration with Nepali engineers in Iceland and Italy with field study and household surveys.

Caribbean Hurricane 2021

Catastrophe Modelling: Vulnerability and exposure estimation for 15 building construction classes in each of 20 Caribbean countries to support reinsurance modelling by Guy Carpenter

Italy Earthquake Vulnerability Model 2014

Risk Assessment: Earthquake vulnerability curves for Italian commercial and industrial building stock. Part of a study for the development of the GEVES Italy Earthquake Vulnerability Model (2.0) carried out for PartnerRe in 2014.

Tohoku Tsunami Japan 2011

Disaster recovery:

EEFIT recovery mission and case study of spatial planning issues.

EEPI Map 2013

Impact Database: Web-accessible geographical database of building damage photos to support earthquake risk studies (www.snapandmap.com).

EXPLORIS 2005-2007

Volcanic risk assessment: EU-funded research collaboration for development of eruption scenarios for three European volcanoes (Vesuvius, Tiede (Tenerife) and Soufriere (Guadeloupe) to assist planning for risk mitigation.

Who we are

Luca Leone

MA DipArch DipUDP

Luca Leone is an urbanist working in the field of sustainable development and management of the built environment. In the risk field, he has been responsible for product development and marketing of the Global Event Vulnerability Estimation System (GEVES), CAR’s flagship catastrophe modelling range for the reinsurance industry.

Robin Spence

MA MSc PhD FIStructE MICE

Robin Spence is a structural engineer and Emeritus Professor of Architectural Engineering in the Department of Architecture at the University of Cambridge. His principal research and consultancy interests are disaster risk assessment and disaster mitigation. He has directed numerous research and consultancy contracts and is the author of several books and more than 150 technical papers in these areas.

Stephen Platt

BA MSc PhD

Stephen Platt is a social scientist with experience in urban planning, housing, energy use and post-disaster reconstruction. He has been studying disaster management and recovery since 2006 and has conducted case studies in more than a dozen countries hit by natural disasters of earthquake, storm and flood.

Hannah Baker

BA MA PhD

Hannah Baker’s interests are in urban development and risk in the built environment. Her doctorate at the University of Cambridge Department of Engineering focused on demolition and adaptation of existing buildings on urban development projects, including case studies in the UK, The Netherlands and Australia. Hannah has worked on a range of projects at CAR, mainly with the Risk team.

Antonios Pomonis

DipCivEng MScEng

Structural engineer specializing in disaster risk management and modelling with more than 30 years of experience. Currently at the World Bank’s Urban, Disaster Risk Management, Resilience and Land Global Practice (GPURL)

Peter Baxter

MD MSc FRCP FFOM

Peter Baxter is an authority on the health effects of volcanic eruptions and other disasters. He is a retired Consultant Physician in Occupational and Environmental Health at the University of Cambridge and Cambridge University (Addenbrooke’s) hospital.

Giulio Zuccaro

MA MSc PhD FIStructE MICE

(Graduated as Architect in 1980, Member of Professional Association of Naples Architects since 1982)

Architect and structural engineer with expertise in geohazard engineering and climate change adaptation, impact/risk modelling and evaluation and risk reduction techniques. He is a Full Professor at the University of Naples Federico II, and Science Lead at the Plinivs Study Centre, Centre of Competence of the Italian Department of Civil Protection.